Some Ideas on Paul B Insurance Medicare Supplement Agent Huntington You Need To Know

Yet you can have other double insurance coverage with Medicaid or Unique Requirements Strategies (SNPs).

Medicare health strategies supply Part A (Hospital Insurance) and also Component B (Medical Insurance coverage) benefits to people with Medicare. These plans are normally provided by exclusive companies that contract with Medicare. They consist of Medicare Benefit Program (Component C) , Medicare Cost Strategies , Demonstrations / Pilots, and Program of Complete Take Care Of the Elderly (RATE) .

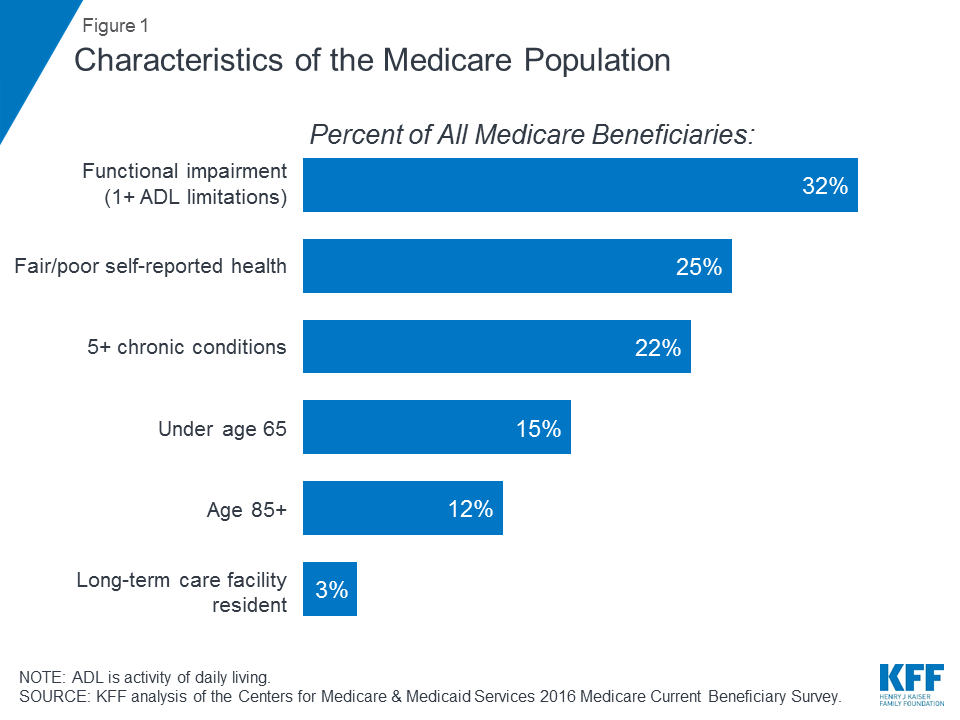

Medicare is the government medical insurance program for people 65 or older, as well as individuals of any kind of age with specific impairments.

An Unbiased View of Paul B Insurance Medicare Agent Huntington

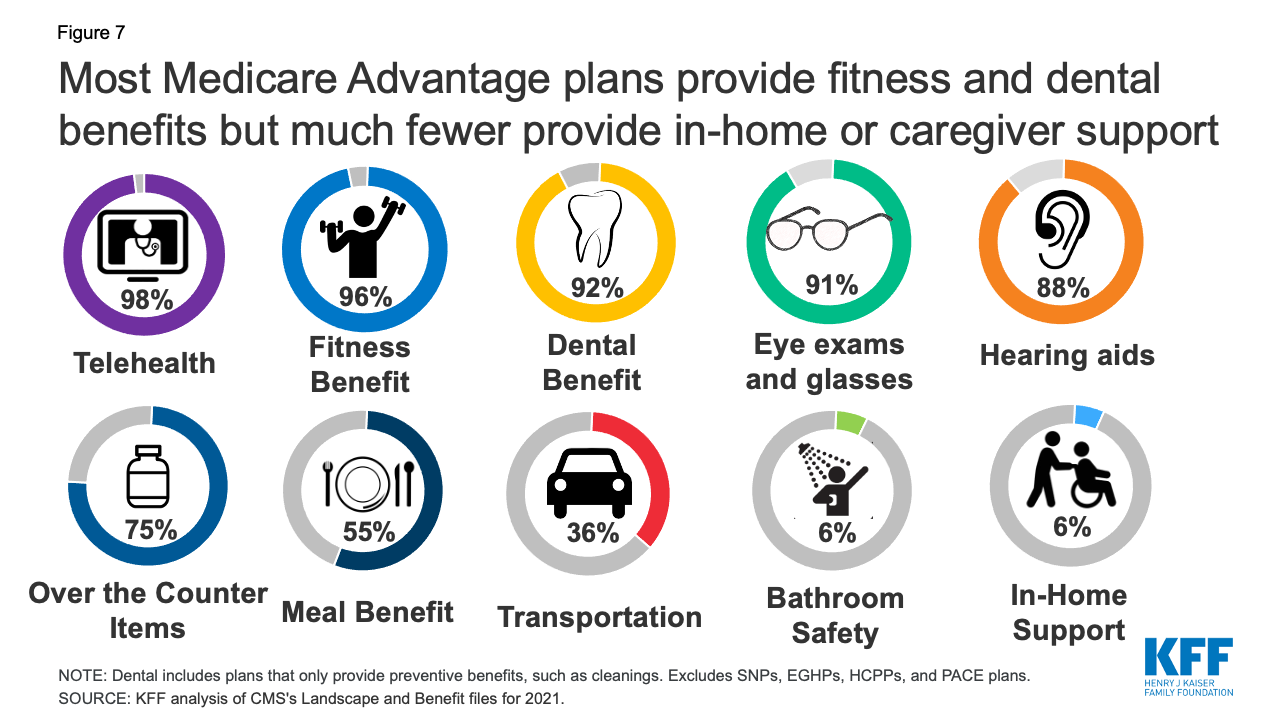

They cover whatever Original Medicare does as well as much more, sometimes consisting of additional advantages that can conserve you cash and also assist you remain healthy. There are fairly a couple of misconceptions regarding Medicare Benefit strategies.

It covers some or all of what Original Medicare does not pay, however it does not come with additionals. You can not enlist in both a Medicare Benefit and Med, Supp strategy, so it's crucial to recognize the resemblances and also differences between the 2.

They're vital to believe about, since Original Medicare and Medicare Supplement Plans do not cover prescription medications. Nonetheless, PDP protection is consisted of with lots of Medicare Benefit Plans. As you get closer to age 65, there are necessary choices you'll need to make about your health care. To take advantage of Medicare, you need to recognize your choices and how they work.

Brad and also his better half, Meme, know the value of excellent solution with good benefits. They selected UPMC forever since they desired the entire bundle. From physicians' check outs to oral coverage to our acclaimed * Health Treatment Concierge team, Brad and also Meme understand they're obtaining the treatment as well as answers they require with every phone call and every see.

Indicators on Paul B Insurance Local Medicare Agent Huntington You Should Know

An FFS option that permits you to see clinical providers who decrease their charges to the plan; you pay less cash out-of-pocket when you utilize a PPO service provider. When you visit a PPO you typically will not need to file claims or documents. Nonetheless, mosting likely to a PPO hospital does not guarantee PPO benefits for all services got within that hospital.

Usually registering in a FFS plan does not assure that a PPO will certainly be available in your area. PPOs have a stronger presence in some regions than others, and navigate to this site also in areas where there are local PPOs, the non-PPO advantage is the conventional advantage.

Your PCP provides your general treatment. In numerous HMOs, you must get permission or a "recommendation" from your PCP to see various other suppliers. The recommendation is a referral by your medical professional for you to be assessed and/or treated by a different doctor or doctor. The recommendation makes sure that you see the best provider for the care most proper to your condition.

Paul B Insurance Medicare Agency Huntington - Truths

A Health and wellness Interest-bearing accounts permits people to spend for present wellness expenditures and also save for future professional medical costs on a pretax basis. Funds transferred right into an HSA are not strained, the equilibrium in the HSA grows tax-free, and that quantity is readily available on a tax-free basis to pay clinical prices.

Medicare recipients pay absolutely nothing for a lot of precautionary solutions if the services are received from a medical professional or various other health treatment service provider who takes part with Medicare (additionally understood as approving project). For some precautionary services, the Medicare beneficiary pays absolutely nothing for the solution, but might have to pay coinsurance for the workplace check out to obtain these services.

The Welcome to Medicare physical examination is an one-time review of your health and wellness, education as well as therapy concerning preventive services, and also referrals for various other care if required. Medicare will cover this examination if you obtain it within the very first one year of enrolling partially B. You will certainly pay nothing for the test if the physician approves task.

How Paul B Insurance Medicare Insurance Program Huntington can Save You Time, Stress, and Money.

On or after January 1, 2020, insurance useful source firms are needed to offer either Plan D or G in addition to An as well as B. The MACRA modifications also developed a new high-deductible Plan G that may be supplied starting January 1, 2020. To find out more on Medicare supplement insurance plan design/benefits, please see the Benefit Chart of Medicare Supplement Plans.

Insurers may not deny the candidate a Medigap policy or make any type of costs price differences as a result of wellness condition, asserts experience, clinical condition or whether the candidate is obtaining healthcare services. Nevertheless, eligibility for plans offered imp source on a team basis is restricted to those people who are participants of the team to which the policy is released.